We all like to have mixed vegetables curry with Roti/rice and also like to have other vegetables curry like Potato. We cannot have always potato because it may increase the chance of Diabetes where mixed vegetable curry is the multi-vitamin source from different vegetables, which is good for our health.

Let’s take an example of this scenario:

Investor1-(Jackson): Mix-Vegetables Curry Porfolio

Who normally believes in some long-term investment with minimum holdings period of one year. He has also good knowledge of portfolio diversification and allocates funds depending on the stock risk, volatility, technical performance, etc.

In the year 2019, he got an annual bonus 5 Lakh from his company and decided to create a portfolio in the stock-market through his brokerage account.

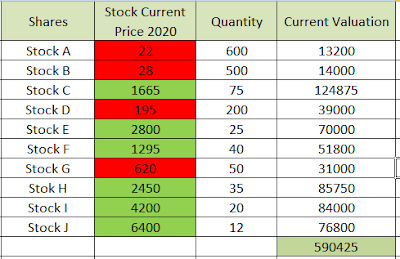

He had created his portfolio by doing his own risk and mathematical calculation as below:

He frequently checks his portfolio’s health and performance, so in the current year 2020, he has generated his portfolio's holdings report as below and decided to full exit from his portfolio with a net profit of amount 90425/, the net percentage of return is 18.085% in a year.

Investor2-(Babson): One Vegetable Curry type Portfolio

Who is a risky player and don’t have much knowledge of risk management, portfolio diversification. One of his friends suggested he take a trade position in stock A (Currently trading price 120 ), which is a good stock that can potentially give 100% return within a year as somebody in some forum suggested.

He got 5 Lakh from his fixed deposit maturity last Jan 2019. As he is a risky player, so he decided to take 2000 buy positions at price 120. After some-month in April, the stock price went down to 80 and again he bought 1000@80. Similarly, he bought in Aug 1200@70, 1600@60, total quantity of 5800 he bought with total amount of 5 Lakhs.

Portfolio Value in the year 2020 as below. Net Loss (500000-127600= 372400), -74.48%)

Jackson and Babson both have invested in risky stock Stock A, however, as per Jackson, it was risky stock so only allocated 72000 of the total amount which is 14.41% approx, whereas Babson has no knowledge of risk calculation and tried to average out the price but finally stock price ended with 22 which cause total loss 74% of his initial capital.

So, whenever somebody is going to create the portfolio, do proper risk calculation, ratings, and details analysis of the stock.

Well explained Portfolio Management

ReplyDeleteThanks for another good blog. It really helps to understand everyone in a much simpler way with pictorial representation and simple examples.

ReplyDelete